Mar 26, 2010 | Buying Real Estate, Legislation, Realtors, Selling Real Estate

New lead paint regulations go into effect in Massachusetts on April 22, 2010. Although the new regulations do not immediately or directly impact Realtors® and real estate agents, contractors will now be required to be certified by the Environmental Protection Agency in order to perform even the simplest repairs or renovations to properties built before 1978.

According to the state Childhood Lead Poisoning Prevention Program as much as 30 percent of childhood lead poisoning cases in Massachusetts involve exposure to lead dust caused by renovation work. That is a serious figure considering the devastating, life long effects of lead poisoning. Homeowners who have work performed on their property by contractors, including painters, plumber, electricians and carpenters, must ensure that the contractor is “EPA Lead Safe Certified.”

The rule can be summarized in four parts:

- Training and Certification

Beginning in April 2010, firms working in pre-1978 homes will need to be certified. In addition to firm certification, an employee will also need to be a Certified Renovator. This employee is responsible for training other employees and overseeing work practices and cleaning. The training curriculum for certification, in development with the EPA, will be an eight-hour class with two hours of hands-on training. Both the firm and renovator certifications are valid for five years.

.

- Work Practices

Once work starts on a pre-1978 renovation, the Certified Renovator has a number of responsibilities. Beginning with distributing EPA’s Renovate Right brochure to the homeowner and having them sign the pre-renovation form in the booklet. Before the work starts the Certified Renovator will post warning signs outside the work area and supervise setting up containment to prevent spreading dust.

The rule lists specific containment procedures for both interior and exterior projects. It forbids certain work practices including open flame or torch burning, use of a heat gun that exceeds 1100°F, and high-speed sanding and grinding unless the tool is equipped with a HEPA exhaust control. Once the work is completed, the regulation specifies cleaning and waste disposal procedures. Clean up procedures must be supervised by a Certified Renovator.

- Verification and Record Keeping

After clean up is complete the Certified Renovator must verify by matching a cleaning cloth with an EPA verification card. If the cloth appears dirtier or darker than the card, the cleaning must be repeated. A complete file of records on the project must be kept by the certified renovator for three years. These records include, but aren’t limited to verification of owner-occupant receipt of the Renovate Right pamphlet or attempt to inform, documentation of work practices, Certified Renovator certification, and proof of worker training.

.

- Exemptions

- The home or child occupied facility was built after 1978.

- The repairs are minor, with interior work disturbing less than six sq. ft. or exteriors disturbing less than 20 sq. ft.

- The homeowner may also opt out by signing a waiver if there are no children under age six frequently visiting the property, no one in the home is pregnant, or the property is not a child-occupied facility.

- If the house or components test lead free by a Certified Risk Assessor, Lead Inspector, or Certified Renovator.

.

In pending real estate transactions real estate professionals should be certain that homeowners are aware of the new regulations, particularly if a seller is doing renovations or repairs to the property in preparation for the sale. Without doubt there will be a new form or two to be executed at the time of listing and or at closing.

Buyers purchasing properties constructed prior to 1978 (and there mortgage lenders) will certainly be looking for representation from sellers that the property is in compliance with the new regulation. Expect to see new language included in purchase and sale agreements accordingly.

Of course the EPA has published a list of frequently asked questions about the RRP Rule:

—

Feb 4, 2010 | Buying Real Estate, Legislation, Mortgage Lenders, Realtors

These most recent FAQs offer additional guidance on the following issues:

- A loan originator can require the use of a particular provider of flood certification and tax service as long as that provider is not affiliated with the lender;

- Pages cannot be added to the GFE but it may be printed on legal size paper and the shading and margins can be changed;

- How to deal with the situation when an FHA approved loan correspondent closes a loan in its name that is not table funded by its sponsor;

- What items can change when a new GFE has been issued and the interest rate has not been locked;

- Clarification of some of the requirements when mortgage brokers and lenders interact;

- What items can change when a revised GFE is issued and the borrower has previously locked the interest rate;

- Lenders may not require a borrower to sign consents to verify employment, income or deposits prior to issuing a GFE;

- Verification documents can be requested after a GFE has been issued;

- Lender can indicate that although it has identified certain providers of settlement services these identifications do not constitute an endorsement;

- When a new GFE has been issued borrowers are not required to re-indicate an intent to proceed;

- An escrow waiver fee is a type of loan level price adjustment and may be part of the calculation of Block 2 on the GFE;

- The Y.S.P. payment cannot be shown on the HUD-1 as POC;

- If a lender requires a condominium certificate and questionnaire for loans on condos, that charge should be listed on Block 3;

- Charges that are part of the sales contract, but are not required by the lender, are not disclosed on the GFE;

- The fee paid by the seller for the preparation of deeds or closing charges should be disclosed in a blank line of the 1100 series in the seller’s column; and

- If an appraisal is subcontracted by Company A to Company B, then Company A’s name should be identified on Line 804.

Jan 25, 2010 | Buying Real Estate, Interesting Stuff, Mortgage Lenders, News, Realtors

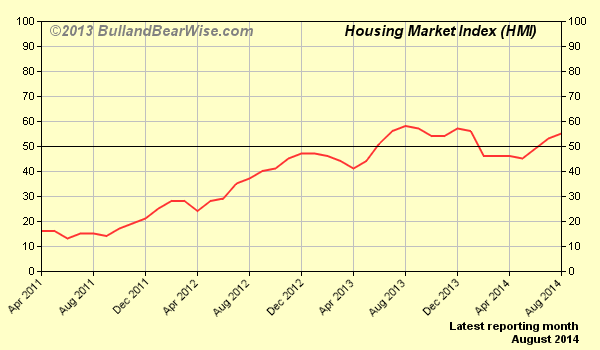

An index of over 300 home builders, which shows the demand for new homes. The index runs from 0-100, so a rating of 50 would mean that demand for new homes was average. Data used in the index is provided by the National Association of Home Builders (NAHB).

The index is not as comprehensive as formal housing reports like new home sales or MBA mortgage applications, the index is more like a supplemental indicator for predicting housing trends.

The NAHB Housing Market Index is used to provide general insight to where the housing market is heading. Because new home sales reflect ‘big ticket’ items that require construction and investment, the housing market is often considered an indicator of the direction of the economy as a whole. Growth in the housing market usually means subsequent spending, generating demand for goods and services and the employees who provide them.

he index is not as comprehensive as formal housing reports like new home sales or MBA mortgage applications, the index acts more like a supplemental indicator for predicting housing trends. As such, the NAHB Housing Market Index is still able to provide general insight to where the housing market is heading. Given that new home sales reflect ‘big ticket’ items that require construction and investment, the housing market is often viewed as an indicator of the direction of the economy as a whole. Growth in the housing market will spur subsequent spending, generating demand for goods and services and the employees who provide them

Jan 18, 2010 | Buying Real Estate, Mortgage Lenders, News, Realtors

The Washing Post, LA Times and other sources are reporting an increased account of the use of borrower loan “worksheets.” In an effort to avoid being bound by newly implemented RESPA (Real Estate Procedures Act) regulations governing real estate mortgage consumer Good Faith Estimates and Settlement Statements, some mortgage lenders have been providing potential borrowers with worksheets that estimate what their loan might cost. These “worksheets” are completely unregulated and were not at all anticipated under the recent RESPA reform.

The loan scenario-forms/worksheets have no requirement for accuracy and loan officers are not bound by any sort of disclosure. Ultimately, the lender still must provide a regulatory Good Faith Estimate and the Settlement Statement (HUD Form 1) must conform to it, but right now the average consumer is not aware of that fact. Once the loan shopper is “satisfied” with what was “disclosed” on the worksheet, and only days before closing, the consumer is presented with the obligatory GFE.

Loan officers and lenders claim the worksheets are necessary to remain competitive and that the new regulation is too strict to be a practical benefit to the consumer. The regulatory demand for 90% accuracy is overbearing say some mortgage professionals.

A HUD official said that they will continue to monitor the practice and update the reform accordingly.

In the mean time mortgage shoppers should be certain that they are working with experienced, trustworthy lenders and loan officers. If you need the name of a local trustworthy loan officer – call me anytime and I will introduce you to one of my finest lender clients.

Jan 8, 2010 | Buying Real Estate, Mortgage Lenders, News, Realtors

Reporting on all forms of payment, including cash, retail sales rose 3.6% from November 1 through December 24, according to a top credit reporter. Internet sales popped up 18%, consumer electronics rose 5.9% and jewelry sales climbed 5.6%. Major economists had anticipated overall retail sales to remain unchanged. They were mistaken.

Initial claims for unemployment benefits fell by 22,000 to 432,000 in the week ending December 26. It was the lowest pace since July 2008. Continuing claims for the week ending December 19 fell by 57,000 to 4.98 million, the lowest level since February 2009.

Freddie Mac reported Thursday that after four straight weeks of increases, 30-year fixed-mortgage rates dropped to an average of 5.09% this week, reducing real estate mortgage costs for home buyers.

Last week the rate averaged 5.1%; last year at this time the rate was 5.01%. The average 15-year fixed mortgage rate dipped 0.4% to 4.5%, and the average five-year adjustable-rate mortgage remained flat. The average one-year ARM edged down 0.03% to 4.31%.

The Federal Government now holds $909 billion of mortgage-backed securities. Since the beginning of 2009 it has purchased 73% of the mortgages that government-backed Fannie Mae, Freddie Mac and Ginnie Mae have turned into securities.

If mortgage rates spike up or the economy weakens, economist speculate, that the central bank might need to keep buying mortgage-backed-securities. However, with the economy improving and the mortgage market already heavily dependent on government, officials are eager to leave the business of purchasing MBS’s.

After expiration of the current, extended, home buyer tax credit the U.S. real estate market may be left to stand on its own. That will be the true test of the recovery.

Dec 22, 2009 | Buying Real Estate, Realtors, Selling Real Estate

Home resales are expected to have risen to their highest level in nearly three years in November, as an extraordinary level of federal support has pulled the housing market back from the worst downturn since the Great Depression.

Economists project home sales rose 2.5 percent to a seasonally adjusted annual rate of 6.25 million, up from 6.1 million in October, according to Thomson Reuters. If accurate, it would be the third-straight increase and the best month for home sales since February 2007.

The National Association of Realtors’ report is scheduled for release at 10 a.m. EST Tuesday.